Latest News

The Role Of Ventilation In Controlling Virus Transmission In Offices

The way buildings are ventilated is under intense scrutiny in the wake of the pandemic. The importance of being able to dilute airborne contaminants and reduce disease transmission in indoor spaces is now at the top of the political agenda. In October 2021, the...

Focus on Home Office Air Conditioning

Changes in working practices implemented due to Covid 19 have meant that increasing numbers of clients are working from home. A growing realisation that home working may become a semi permanent feature of our lives, has led many to invest in improvements in both the...

The new Mitsubishi MSZ-LN

The new Mitsubishi MSZ-LN wall mounted system is a blend of energy efficiency and sophisticated design. Finished in a range of deep, rich colours with a premium quality feel, this system is the latest addition to the Mitsubishi range and has some unique features...

Control and monitor your system using Melcloud

The latest control and monitoring system introduced by Mitsubishi on selected models allows you to control and monitor your air conditioning systems using your PC, Tablet or Smartphone. Using an integrated wifi adapter fitted inside the air conditioning indoor unit,...

Time to move to R32

The next generation of refrigerant is now available in limited products for UK customers.R32 offers a Global Warming Potential reduction of two thirds and a better system efficiency with better heating performance at lower ambient temperatures.Previous generation...

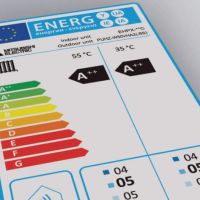

Ecodesign Directive Sets New Standards

The Ecodesign Directive for Energy Related Products (ErP) is European legislation designed to improve the energy efficiency of all products which consume energy. When we exit the EU, this will remain part of UK Law. ErP comes into force for all new air conditioning...